A healthcare spending account (HCSA) is a benefits solution that can be used either as a complement to a core health and dental plan, or as a standalone option.

What Is It?

What Is It?

Essentially, an HCSA is a pool of money available to employees and their families, which an employer funds monthly throughout the year.

It’s great for employers because they can:

- 1. Control how much they would like to spend on the HCSA

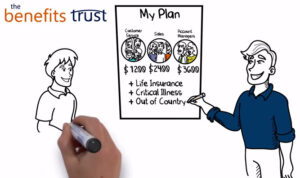

- 2. Define “groups within their group” to customize how much funding each group of employees receives (can be based on seniority, position, etc.)

- 3. Count it as a 100% tax-deductible business expense

It’s great for employees because they can:

- 1. Spend their funds on any Canada Revenue Agency (CRA) approved expenses (encompassing much more than is covered by conventional benefits plans)

- 2. Receive tax-free benefits dollars

If you want to learn more about how HCSAs work and how they can help your business, watch our brief video:

Whether you are looking for creative ways to control your health and dental expenditures or a new strategy for rewarding your key employees, a healthcare spending account can be an ideal solution.

>> The Benefits Trust can help you integrate an HCSA into your current plan, or build a new customized benefits solution unique to your business. Contact us today!

Check out our FREE eBook for a comprehensive look at HCSAs: “The Smart Business Owner’s Guide to Healthcare Spending Accounts.”

More on HCSAs from The Benefits Trust: