HSA ACCOUNTS

Healthcare Spending Accounts for Businesses

What is a Health Care Spending Account?

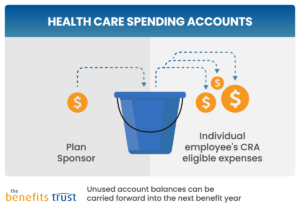

A Health Care Spending Account is a pre-determined amount of money provided to employees at the beginning of each benefit year for coverage of their medical and dental expenses.

As easy to process as a conventional benefits plan, claims are submitted by employees and reimbursed by our team. Eligible expenses are paid fully, up to the total dollar amount available in the HCSA. A Healthcare Spending Account can replace or exist alongside conventional medical and dental coverage.

Healthcare Spending Accounts

Plan Highlights

- An HSA provides the broadest possible definition of coverage for any plan in Canada.

- All benefits are received tax-free by the employee.

- It provides complete coverage flexibility for any CRA-approved health, drug, vision, and dental expenses.

- It can replace or exist alongside conventional medical and dental coverage.

- An HCSA can be supplemented with optional pooled benefits such as Life, AD&D, Critical Illness, Long-Term Disability, and Travel Insurance.

- Employer sets an exact budget for employees and always knows the maximum cost.

- Employers can recover unused amounts at the end of the year.

- Can be set up as a top-up supplemental plan for your existing plan.

- An HSA provides complete flexibility to the employee to use the funds as needed, and total cost control to the owner.

- An HSA also offers 100% budget certainty. Rates will never change unless directed by your company.

Coverage Amount

- The HCSA limit is fixed by the employer and can be changed at annual renewal.

- HCSA limits can differ for different classes of employees based on your preference.

- All expenses will be paid at 100%, up to the set limit.

Administration Fees

- 10-20% of contributions

- No setup fees, annual fees, per-claim fees, or fees for booklets.

What’s Covered?

- Drugs

- Dental, including orthodontics and implants

- Vision, including laser surgery

- Expenses related to physical and learning disabilities

- Paramedical and registered therapists

- Hospital Coverage

- Any CRA-approved medical expense is eligible

Optional Catastrophic Coverage

Optional catastrophic coverage can include the following:

- Travel insurance

- Life insurance

- Accidental death and dismemberment

- Critical illness

- Long-term disability

- Catastrophic drug coverage up to $1 million over a lifetime

Online/Smartphone App Claim Submission?

Benefits Card?

Pay Direct Drug Card?

Interested in a Healthcare Spending Account?

Talk to your advisor, call us for a 10-minute chat, or submit a callback form.

What Makes an HCSA Different with The Benefits Trust

Our fees are all-inclusive, which means:

- No plan set-up fees

- No claims processing fees

- No annual fee

- No fees for issuing booklets

- Advisor’s commission is already included in the administration fee

- No “account maintenance fee” for employee accounts (often deducted by other providers)

The Benefits Trust HCSA Process

The Benefits Trust offers HCSAs as an annual benefit funded on a monthly basis. In this way, we don’t treat HSAs any differently than a traditional style plan.

Employees shouldn’t have to wait to submit claims – with our plans, the full annual amount is available from day one. All HCSA funds belong to the employer, who will always receive a refund of unspent HSA dollars at the end of one or two benefit years, depending on their chosen plan structure.

Some providers adjudicate HSAs on an as-earned basis, and many offer only “pay-as-you-go” plan funding. This can be a challenge for companies if each expense must be approved and a cheque must be written for each batch of claims. It’s also a challenge for your employees if they must wait for a batch to be submitted. Our approach ensures claims are processed quickly so your employees are reimbursed just as fast.

Our approach with stable monthly funding protects against the cash crunch that affects so many businesses. We allow our members to carry surpluses or deficits without interest applied to either. We provide clear, accurate reporting to employers in monthly financial statements as well as during year-end reconciliations.

Common Questions and Resources

How does a Healthcare Spending Account work?

At the beginning of each year, the plan sponsor decides the amount of HCSA dollars available in each employee’s account. This is usually designated by class of employee or time served at the company; for example, executives could receive $3,600 per year, and all other employees $1,200 per year.

Employees and their families can then claim from their HSA account to cover Canada Revenue Agency (CRA) approved health and dental expenses as they encounter them throughout the benefit year. This allows employees to spend the funds on expenses their families incur rather than restricting them to the limits set out in a conventional benefits plan.

Healthcare Spending Accounts ensure controlled benefits costs for the employer and complete claim flexibility for employees.

What are the tax advantages of an HCSA for an employer?

As with a conventional employee benefits plan, the cost of an HCSA health plan is a tax-deductible business expense, and benefits are received tax-free. To be considered a tax-deductible expense to the plan sponsor, a Health Care Spending Account must have a pre-set limit, which is 100% employer-funded. The funds cannot be used to purchase additional insurance (i.e., life insurance). Unused HCSA amounts cannot be paid out at year-end as cash to employees.

Healthcare Spending Accounts provide employers with complete control over claims costs each year because the employees can only claim up to their individual maximums. Funds that are not used for claims within the specified period remain the property of the plan sponsor and are returned to them.

For more information on setting up Health Care Spending Accounts for your Canadian company, call your insurance advisor or contact us today.

What benefit expenses are eligible for coverage?

Under the Income Tax Act, any item that qualifies for the Medical Tax Credit is eligible for coverage through an HCSA. Please refer to the CRA website for a detailed list of eligible expenses.

This definition of eligible expenses is broader than that of a conventional employee benefits plan, allowing for additional flexibility for employees and executives in particular.

We Can Match Your Existing Plan

Our team can quickly adjust and change your existing plan to work perfectly for you.

Most Traditional Employee Benefits Plans Look the Same

Cost

Service

Plan Design

Support

Have an Inquiry About Our Plans?

Call us at 1-800-487-2993

Email us at [email protected]

Regular Hours of Operation:

Monday – Friday 8:30am – 5:00pm