We Help Successful Business Owners Build Better Benefits Plans Than They Can Get Anywhere Else.

- request a quote

- request a quote

- view our plans

- learn about what we do

- speak to us

Design A Custom Plan

We offer custom benefits plans that are built around your team size, structure, and goals, from solo owners to large organizations.

Enjoy More Coverage

Our plans are flexible and scalable, adapting easily as your company adds new employees or tiers of coverage.

True Customer Service

We think outside of the traditional benefits box and pride ourselves on better customer experiences.

WHY THE BENEFITS TRUST?

A Fresh Approach to Employee Benefits

We’ve been approaching employee benefits plans a little differently than traditional providers.

Every group benefits plan we create is based on current employee and business needs and desires while also taking into account future business goals.

We offer flexibility in our coverage options while keeping you within your budget.

Tailored Benefits Plans For Any Business Size

A CULTURE OF CARE

Help Your Employees Rest At Ease With Coverage For Unexpected Expenses.

Show your employees that you care about their well-being by providing them with better benefits and peace of mind when they need it.

Invest in a benefits plan that keeps your employees happy and your business thriving.

Take A Look At What Our Clients Are Saying.

ASSOCIATION PLANS

Specialized Health Benefits Plans For Your Industry

We’ve created focused benefits plans based on the needs and demands of specific industries. Find your fully customizable plan options here!

Our Featured Blogs

Calling all benefits advisors: find helpful techniques, tips, and industry news in our blog.

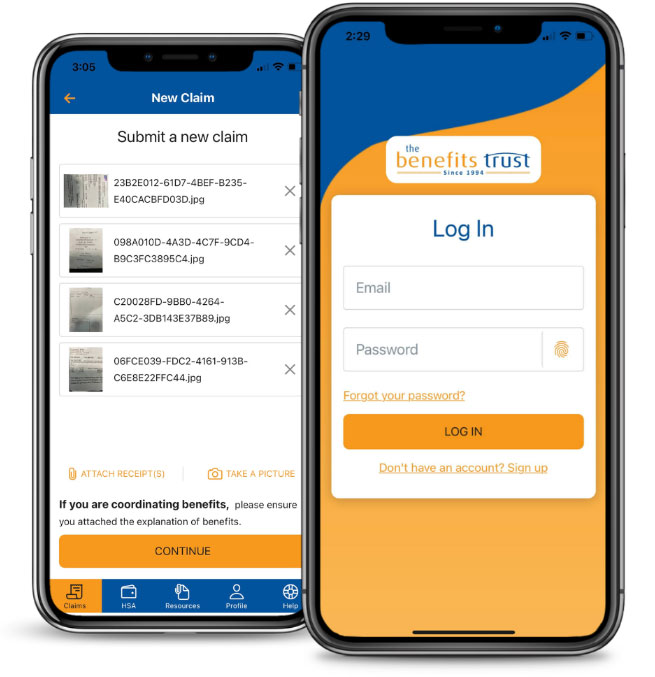

WE’VE CREATED A BETTER CLAIMS EXPERIENCE

Submitting Claims Has Never Been Easier!

We provide better benefits than you can find anywhere else, but we also elevate the experience for plan members with a user-friendly mobile app for hassle-free claims processing. Let us do the work for you! Let us do the work for you!

Contact Us to Find the Right Plan for You!

Choose Your Plan That Fits Your Business

Speak to your advisor or please call us at 1-800-487-2993. We pick up the phone!