Healthcare spending accounts (HCSAs) are growing in popularity, and it’s important as a benefits advisor to truly understand their intricacies. HCSAs provide businesses and employees with unique advantages as part of an employee benefits plan, but there are some common misconceptions surrounding healthcare spending accounts and how they operate.

Let’s dive into everything you need to know about HCSAs and explore their potential applications.

Analyze the Needs of the Client

As with any employee benefits conversation, it’s essential to understand the client and their unique needs. The only way to truly understand their goals and pain points is to ask! We encourage you to focus on future-based questions, as the responses to those questions will effectively provide you with a road map of where the client is headed. With that knowledge, you can work to craft a custom benefits solution that helps them get there.

When using a traditional benefits plan, businesses often fall into the situation where a mere 20% of their employee population is responsible for driving 80% of the cost of that plan. Implementing a healthcare spending account is an effective solution for this issue, and it’s a solution that typically pleases the majority of the plan users as it increases their benefits.

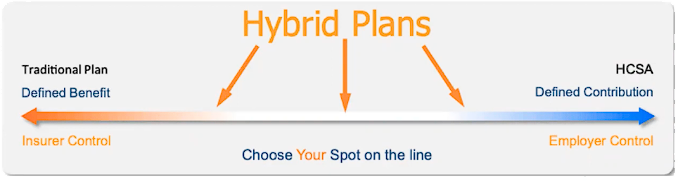

It’s important to understand that healthcare spending accounts aren’t an “either/or” option with traditional benefits plans, but rather they are just one part of a comprehensive employee benefit plan solution. The HSA could account for 100% of that plan, or it could account for just 5%. The size and weight of the HSA is determined by the plan sponsor.

What Exactly Is a Healthcare Spending Account?

Essentially, a healthcare spending account is a bucket of money put in place for each eligible employee. Each bucket is unique to each employee, and those eligible members get to use the money allotted to them in order to reimburse eligible expenses. Employees have the power to use their HSA money in whichever way they see fit, according to their needs and the needs of their family.

The plan sponsor determines the amount in the bucket and the manner in which it’s distributed. That benefit promise is made annually, in advance. There are three options for plan sponsors to choose from: balance carry-forward, expense carry-forward, or no carry-forward (also known as “use it or lose it” plans).

As a benefits advisor, it’s important to understand that employees may be separated into classes, and that each class can be granted a different HCSA amount or carry-forward option. It’s at the discretion of the business to determine how they’d like to segment their team and offer benefits amongst them.

Another crucial consideration to keep in mind is that contributions, administrative fees, and taxes paid by the plan sponsor for HCSAs are 100% tax-deductible business expenses, and reimbursements received by plan members are 100% tax-free.

Where and When Do You Use a Healthcare Spending Account?

The short answer? It depends.

It depends on the business’ compensation philosophy, their benefit philosophy, and their group demographics.

It’s important to ask the right questions to determine those philosophies and how HCSAs may benefit the organization. Are they looking to be a top payor, a low payor, or a competitive payor in their industry? Do their employees work from home or on-site? Does their industry require a particular skillset or special licenses? All of these factors will influence a company’s compensation philosophy – and every company has a compensation philosophy, whether it’s clearly defined or more abstract.

A benefit philosophy might be parallel to a compensation philosophy, though it could also be distinct. Some businesses adopt a “we take care of you” mindset where even if their salaries are not through the roof, they look to completely care for their employees’ healthcare needs. On the flip side, other businesses may prefer to provide generous monetary compensation while they leave healthcare needs to the employees to manage. Ask your clients about their company pay structure, performance-based compensation, and union involvement to help determine their particular benefit philosophy.

Group demographics play a role as well. Family dynamics, age, level of education, gender, and geographic location all influence a group’s needs, and they impact how an employer ought to compensate their team. Determine the level of competition for top talent in their area and consider the unique needs of their employee demographic. Remember, HCSAs are the last payors – traditional benefits plans pay first.

Designing a Healthcare Spending Account

There’s a lot of flexibility when it comes to putting a healthcare spending account in place. There could be a flat benefit provided to all employees in a segment, or the amount in each employee’s account could be determined based on a percentage of their earnings. It could be influenced by years of service, by class, or by a combination of those factors.

As a benefits advisor, crafting custom solutions is the best way to provide value-added service at a profit and it’s the best way to retain clients long-term. The more unique your solution, the harder you will be to replace! Don’t forget that plan solutions are flexible, and you can get creative with how you develop those solutions to best serve the client and their needs.

Key Takeaways for HCSAs

HCSAs are growing in popularity because they empower employees to make their own healthcare decisions while simultaneously providing budget certainty for the plan sponsor. Claims are simpler with an annual benefit setup as opposed to an as-earned approach, and plan sponsors can easily monitor their usage through in-app balance checkers.

Remember, HCSAs are just one part of a benefits plan. They could be used to supplement a traditional plan, or they could be doing the bulk of the heavy lifting. The size and importance of a healthcare spending account is up to the employer to determine.

They provide cost certainty as a tax-effective last payor solution that improves benefits for the majority of the employee population. With flexible plan design, healthcare spending accounts are a valuable tool in your belt as an advisor and understanding how they operate and how to apply them to each clients’ unique needs is a skill well worth developing.

The team at The Benefits Trust is here to help. With almost 30 years of experience in the world of employee benefits we have a wealth of knowledge that we love to share through webinars, articles, resources, and conversations. Contact us today for more information on HCSAs or for any employee benefits questions you may have!