Southern Ontario is a land of endless opportunities, brimming with business activity and a vibrant economy. In this thriving environment, employee benefits advisors have a unique chance to make a significant impact, especially in the market of businesses with 1-100 employees.

Southern Ontario is a land of endless opportunities, brimming with business activity and a vibrant economy. In this thriving environment, employee benefits advisors have a unique chance to make a significant impact, especially in the market of businesses with 1-100 employees.

Did you know that according to a BDC study, 98% of businesses in Canada fall into this category, contributing to a whopping 52% of the nation’s GDP? This presents an exciting landscape for advisors looking to provide value and build long-lasting relationships.

The Promise of Benefit Plans

At the heart of every employee benefit plan lies a promise – a commitment between employers and employees. To create a sticky client and offer real value, advisors must ask their clients future-based questions. This approach not only helps you understand where your client is headed but also how you can best support them on their journey.

Remember, as advisors we are translators, and it’s essential to use simple language to connect with your clients. A question like, “If we were meeting here three years from now and you were looking back over those three years, what has to have happened to say those were the best three years of your life?” can be an excellent starting point for understanding your client’s needs and goals.

The Power of Creative Plan Design

When clients have a creative and custom plan, they tend to stay loyal and satisfied. A custom plan is like a well-fitted custom shirt – it’s hard to go back to the one-size-fits-all approach. Creative plans are tailor-made to meet the specific needs of your clients, providing them with tangible value. Not only do these plans keep clients from looking elsewhere, but they also tend to be more profitable for advisors.

Let’s take a look at some plan elements that can come in handy when building unique, customized plans:

Executive Benefits

Executive benefits cater to business owners, even those with as few as one person in their employ. This package offers the allure of 100% unlimited coverage, providing a safety net that can be invaluable in uncertain times. It includes a fully budgeted Administrative Services Only (ASO) solution, making it a cost-effective choice for business owners.

Notably, this option stands out as the most tax-effective solution for those at the helm. The package doesn’t stop there; it also includes a claim-secure drug card, stop-loss and out-of-country coverage, and offers flexibility in reporting with options like 30, 60, 90, 120, and 180 days. To sweeten the deal, it provides monthly reporting to ensure there are no surprise renewals. It’s a comprehensive offering designed to capture the client’s attention and keep them hooked.

Health Care Spending Account (HSA)

The Health Care Spending Account (HSA) can be an integral part of the benefit promise, reflecting its commitment to providing essential healthcare coverage. Think of it as a financial “money bucket” with a specific purpose. In this arrangement, the plan sponsor fills this metaphorical bucket with funds, and employees can withdraw money from it to cover eligible Canadian Revenue Agency (CRA) expenses.

Importantly, the benefit promises associated with the HSA are made annually in advance, providing stability and predictability. The plan sponsor has the flexibility to determine the amount or formula, with options like balance carry forward, expense carry forward, or no carry forward. As cost certainty becomes increasingly important for plan sponsors, HSAs are gaining popularity as a strategic and effective choice in the realm of employee benefits.

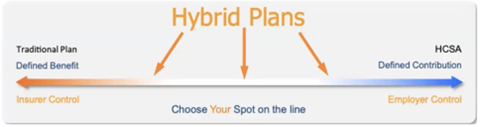

HSAs can be a small or a large part of a creative hybrid benefits plan, and it’s up to the business owner to decide where they fall on the line.

Exploring Creative Plan Designs Through Case Studies

Case Study #1 – Family/Class Consolidation

Challenge

In our first case study, we encountered a company with three separate subsidiaries, each with its own distinct benefit plans that were designed to share in the profits. However, the existing arrangement had become cumbersome, burdening both the company and its employees. While the plans were similar in many aspects, a few key differences made it less than ideal. Additionally, the business had multiple family owners actively involved in the company who had grown frustrated with the restrictive plan design and the limitations of the Cost Plus approach.

Solution

Our strategy was to consolidate these three plans into a single, unified plan with multiple divisions and classes. This approach retained the uniqueness of each subsidiary’s plan while simplifying the administrative process. The outcome was a single billing statement that significantly pleased the client, as they now had just one monthly payment to manage. Notably, the addition of a separate owner class with 100% unlimited coverage effectively eliminated the Cost Plus component, further streamlining the process.

Results

The result was not only a more efficient system but also delighted owners who witnessed a substantial increase in claims, amounting to $30,000 for owners and their families.

Case Study #2 – Mental Health

Challenge

Our second study focuses on a company that had a standard benefit plan in place, but it only included limited mental health coverage, only allowing for clinical psychologist services with a cap of $500 per practitioner. The challenge was to improve mental health benefits without implementing major changes that could disrupt the existing plan. Notably, the company’s owners and management team held a deep concern for the well-being of their employees.

Solution

The solution was innovative yet non-disruptive: the plan’s language was revised to replace “clinical psychologist” with “any registered mental health practitioner,” thereby expanding the scope of eligible providers. Simultaneously, the benefit amount for mental health services was increased from $500 to $1500, while maintaining the $500 cap for other paramedical disciplines. An Employee Assistance Program (EAP) was also introduced.

Results

Our plan created a significant enhancement in mental health coverage, allowing employees to access a broader range of practitioners with ease. This adjustment was very well received by employees and their families, fostering a positive impact on overall well-being. The changes resulted in just a 5% increase in overall costs after the first year, demonstrating that meaningful improvements can be made without substantial financial burden.

Case Study #3 – Performance-Based Benefits

Challenge

In our third case study, an employer sought an innovative approach to link their benefit plan with company performance. The company initially had what they referred to as a “vanilla ice cream” plan in place, offering life, AD&D, critical illness, and medical/dental coverage with an 80% reimbursement rate.

Solution

The new plan involved reducing the medical/dental reimbursement rate to 70% while retaining pooled benefits. An HSA with a $500 flat benefit was introduced, with additional funds allocated based on the previous year’s net profit. These extra funds, equivalent to 5% of the net profit, were evenly distributed among active employees on the plan.

Results

The outcome was a contented workforce that embraced the HSA addition to their benefits package. Furthermore, the monthly sharing of financial results and the enticing incentive fostered heightened employee engagement and increased productivity throughout the organization.

Case Study #4 – Employee Retention Concerns

Challenge

An employer grappling with high employee turnover – primarily among those with less than 1-2 years of service – and faced with the financial burden of extensive new employee training costs sought to address these challenges. Their existing plan included standard benefits such as life, AD&D, and 80% medical/dental coverage.

Solution

The innovative solution involved a phased approach: the plan was adjusted to lower the medical/dental reimbursement rate to 75% for the first year, increasing to 85% in the second year, 90% for years 2-4, and reaching 100% for employees with four or more years of service. Additionally, an HSA was introduced for employees with at least four years of service, starting with a $400 benefit and increasing by $100 each year thereafter.

Results

The new solution created a significant improvement in employee retention, with the enhanced benefits making the company’s plan more competitive, simplifying recruitment. Employees felt valued, and the reduced turnover enhanced the company’s overall culture while concurrently reducing training costs, despite a notable increase in benefit costs.

Case Study #5 – HSA and/or RRSP

Challenge

In our fifth case study we have a company with an existing standard plan that included life, AD&D, LTD, critical illness, and medical and dental coverage with an 80% reimbursement rate, along with an EAP, aiming to differentiate itself in the marketplace and enhance employee satisfaction. The employer’s goal was to make the entire workforce happy with a meaningful change.

Solution

The solution retained the pooled benefits structure while modifying the medical and dental coverage to a 70% reimbursement rate, thus sharing more costs with employees. Furthermore, the employer introduced a $2500 HSA and/or Registered Retirement Savings Plan (RRSP) benefit. The innovative aspect of this plan design was that employees had the choice to pick either the HSA or RRSP benefit or even allocate a portion to both, with these choices made in advance annually.

Results

The result was an overwhelmingly content workforce that embraced the flexibility of choosing benefits that aligned with their individual needs and preferences. The employer, too, was pleased with this creative plan design that set them apart in the market.

Adding Value at a Profit

In the world of employee benefits, value is paramount. As advisors we must exhibit leadership, creativity, and confidence to steer our clients in the right direction, showcasing our capabilities. By providing custom plan designs you increase benefits costs, but the result is happy clients, strong renewals, and ultimately, thin files that lead to profitability. Remember, adding value is more important than merely focusing on lowering costs.

Refine Your Custom Approach with The Benefits Trust

Creative plan design is the key to creating sticky clients who remain loyal and satisfied. By offering tailored solutions and demonstrating value, you can eliminate competition and enjoy easy renewals.

At The Benefits Trust, we help successful business owners build a better benefits plan than they can get anywhere else. Contact us today to learn more about creative plan design and how we can help you unlock the full potential of your client relationships. Your clients deserve the best, and we’re here to help you deliver it.