Solutions for Every Client

As a Trusted Advisor, you know that every client has their own unique goals and providing the perfect solution will look different every time. This is no different when dealing with the issue of high-cost drugs.

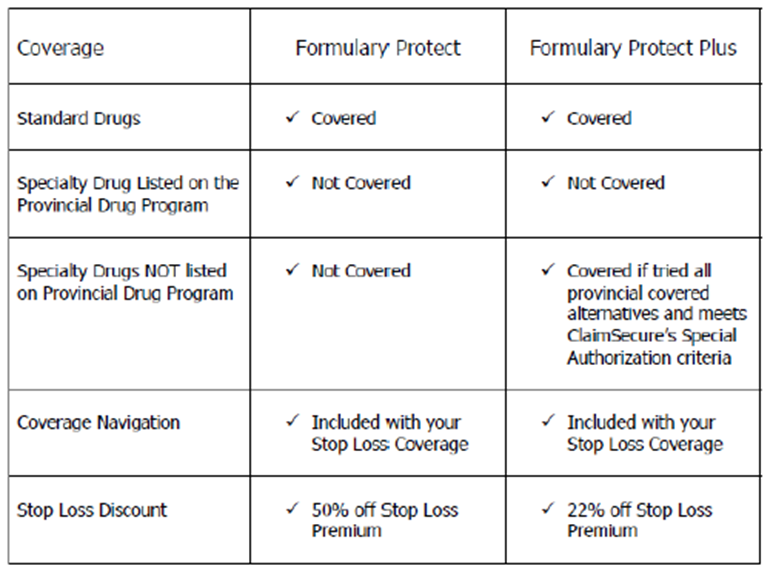

Every client has its own complexities, so you need to be equipped with an arsenal full of potential solutions. When it comes to protecting clients against the high cost of drugs, there are a range of insurance plan configurations that could be ideal, depending on the client and their needs. Some clients will want full coverage using fully insured plans or Administrative Services Only (ASO) with Stop Loss protection, while others will cap drug coverage or implement Health Care Spending Accounts. For the purposes of this blog, we will focus on Formulary Protect and Formulary Protect Plus.

Using Formulary Protect and Formulary Protect Plus to Protect Your Clients

An important part of your role as an insurance advisor is to help your clients control their costs. With Formulary Protect and Formulary Protect Plus on your radar, you’re able to offer your clients additional coverage options in order to provide them with the most fitting solutions for their situation. This coverage is designed to help control the high cost of drugs that often jeopardize a client’s benefits plan while still offering support to members and their families who are dealing with a complicated or challenging illness.

An important aspect to providing your clients with suitable insurance plans is determining and adhering to their level of risk tolerance. Have your clients decide who is taking on the risk – is it them, the insurance company, or their employees? A client with low risk tolerance would lean toward a full coverage plan, while opting for a capped plan passes the risk on to the employee. Work with your clients to determine their views on risk and use that to help guide them to the right solution.

What is Formulary Protect and When is it Used?

The group benefits industry has been looking for protection against the cost of drugs for quite some time. It’s critical that you help your clients find a balance between protecting their employees and ensuring the sustainability of the plan.

Formulary Protect targets high-cost specialty drugs, protecting your client’s benefit plan from any risk of having to pay for these drugs. How? By removing all specialty drugs from coverage (specialty drugs are generally defined as drugs that cost more than $10,000 annually). This coverage also helps find alternative funding for members so they can still access the medication they need.

Use Formulary Protect when the employer wants to remove all financial burden on the plan for high-cost medications. Since this plan also guides employees through the provincial government and drug manufacturer programs available to them, your clients can avoid high risk without passing the financial burden onto their employees.

What is Formulary Protect Plus and When is it Used?

Formulary Protect Plus is a solution similar to Formulary Protect, but with an additional emphasis on ensuring that employees are assisted and not responsible for covering their healthcare costs. This plan involves the client taking on more risk, in order to avoid that risk falling upon their employees. There is a reduced savings on stop loss as compared to the Formulary Protect plan, yet still provides your client with overall savings.

Just as with Formulary Protect, the employee will be guided through all available government programs. In the case where these programs are not able to help your employee, the Formulary Protect Plus plan then utilizes the employer – your client – as a backup after all other routes have failed to provide coverage.

The Financial Impact

We’re seeing a trend in the insurance industry as companies are spending more money on specialty drugs as part of their plans. However, those using Formulary Protect or Formulary Protect Plus coverage mitigate or eliminate the risk posed by high-cost drugs. Keeping the Formulary Protect options in mind for those clients with applicable pain points and risk tolerance has the potential to have a substantial impact.

These plans can help you protect your clients from the high cost of drugs. Through savings gained on the claim itself and the stop loss fee, the Formulary Protect and Formulary Protect Plus plans have the potential to yield significant savings on behalf of your clients, while still considering the needs of their employees.

The Human Impact

With Formulary Protect, in most cases, members will still receive coverage for specialty drugs that have been removed from the plan. Formulary Protect and Formulary Protect Plus offer a service that finds alternative ways for a member to receive funding for their specialty drugs. Funding is sought through:

- Spousal plan coverage

- Provincial drug plans

- Manufacturer patient assistance programs

If the provincial formulary doesn’t cover the specialty drug, then Formulary Protect Plus is an option. With this coverage, the drug is added back to your client’s plan as a safety net in case alternative funding isn’t found.

Another benefit the Formulary Protect and Formulary Protect Plus coverage offers is assistance with the application process, including filling out the application form and complete drug history, and providing a letter showing that the drug is not covered on the member’s corporate plan. Correctly completing an application helps speed up the process and reduces the member’s wait time.

A huge advantage of this coverage is that it provides complete advocacy on behalf of a member when dealing with:

- Provincial administrators

- Case managers and specialist physicians

- Pharmaceutical manufacturers

The advocacy component of this coverage will be valued by many business owners because when someone needs a high-cost specialty drug, it means that the employee or one of their family members has a significant illness. This is usually an emotional time that requires an insurance professional who is caring, attentive, and has stellar communication.

“Compassion is one of the most important things we can help with in this situation because these individuals are taking tertiary medications for advanced conditions,” says Dave Wowchuk, Vice President Sales for ClaimSecure. “We identify those applications that need to be fast tracked (drugs for cancer treatments, for example) with provincial governments because our team really understands the disease status and how to work with physicians and case managers on the pharmaceutical side,” he adds.

Traditionally, advisors have been offering this advocacy on a case-by-case basis, and while it is the right thing to do, it is very onerous and time consuming. “Knowing how to manage clients provincially and across disease states is important,” Wowchuk says. “There were 150 applications this year for new specialty drugs, and we study each one.”

Success Rate

The Formulary Protect and Formulary Protect Plus coverage have had a 95% success rate at finding alternative funding for high-cost drugs for over 3,500 clients since their inception in 2016.

With that success in mind, it is important to explain to clients that whether a member receives alternative coverage will depend on a number of factors and must be looked at on a case-by-case basis.

What If a Client is Already Using a High-Cost, Specialty Drug?

In the case where members are already using a high-cost drug, plans can be amended to address existing claims – as always, it comes down to the intricacies of the situation, and what’s best for that client. At The Benefits Trust we ask pertinent questions, present all the options, and then make determinations based on each client’s goals and situation.

Our team understands how important it is to offer customized solutions to clients while balancing costs against employee needs. Contact us at The Benefits Trust today to learn more about how to help your clients and their members protect against the high cost of drugs.