The 2023 Benefits Canada Healthcare Survey is here and brings a wealth of new insights into how plan members and sponsors navigate the healthcare benefits landscape. We’ve dug into the survey details for you, highlighting critical information that will help you best support your clients and enhance your role as an advisor.

Balancing Costs and Coverage

Costs and coverage in healthcare benefits have always been a tightrope walk. With 60% of plan sponsors reporting an increase in the overall costs of their benefits plans for a variety of reasons while coverage maximums stayed more or less the same for the last 20 years, it’s clear that crafting plans that are both cost-effective and comprehensive is a challenge.

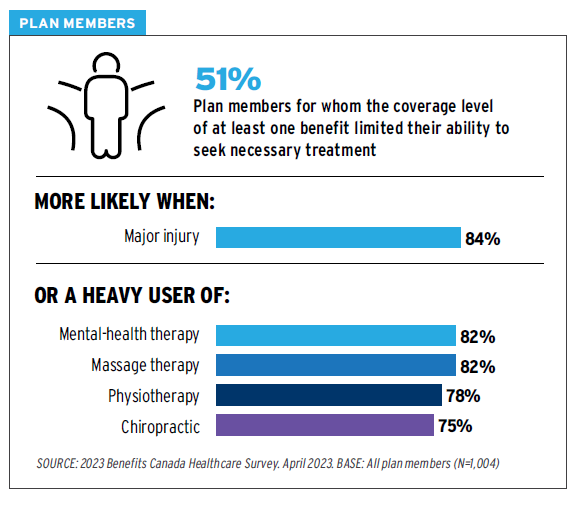

Nearly half of plan sponsors identified that the most important way to improve their health benefits plans was to increase their coverage amounts to keep up with inflation. Members identified that several services didn’t meet their coverage needs, with over 50% saying their coverage for at least one benefit limited their ability to seek the treatment they needed, most likely when they’ve received an injury, or use mental health therapy, massage therapy, or physiotherapy.

Advisors must be adept at navigating these financial and coverage complexities to create plans that serve both plan sponsors and members adequately.

Understanding and Support are Key

Navigating through benefits plans can be a complex journey for plan members. While having robust benefits plans, complete with tools, interfaces, and websites, is crucial, these resources are only valuable if members understand how to use them.

The 2023 Benefits Canada Healthcare Survey revealed that understanding of benefits has dipped, with 11% of plan members feeling they don’t comprehend their benefits, as opposed to 4% five years ago.

Effective communication is critical to bridging this gap and is vital for educating plan members and ensuring they make the most of their benefits. Currently, plan sponsors primarily use email (50%) and their insurer’s website (38%) for communication, but there’s a clear appetite for more.

28% of plan members have expressed a strong desire for navigation services to be included in their benefits. At The Benefits Trust, we provide resources like calculators, online claims, and a claim app to streamline the process and assist plan members in navigating their benefits with ease and clarity. Using tools like these helps to demystify the often complex world of benefits, ensuring members can access and utilize their benefits effectively and confidently.

Personalization in Communication

Personalized communication is not just a preference; it’s becoming a norm. A significant 64% of plan members expressed a keen interest in receiving information specifically tailored to their plan usage, like recommendations for services or information on how to manage their health conditions.

This isn’t just about delivering information – it’s about delivering the right information at the right time, ensuring that members receive relevant, timely details when they need them most. This approach not only boosts understanding but also enhances the use of available benefits.

Personalized communication, therefore, stands out as a powerful strategy to ensure that information is shared and effectively absorbed and utilized by plan members, aligning with their specific needs and circumstances.

Diving Deeper

While we’ve spotlighted specific aspects of the survey, the 2023 Benefits Canada Healthcare Survey also brings to light other vital areas like mental health concerns and chronic pain insights. For a more detailed understanding and to formulate nuanced strategies, we encourage you to download and review the survey for yourself.

Let’s Navigate the Future Together

At The Benefits Trust, we help successful business owners build a better benefits plan than they can get anywhere else. We work with our advisor partners and business owners to navigate the world of employee healthcare benefits and overcome some of the many challenges highlighted in this benefits survey. Talk to your benefits advisor or contact us today, and let’s navigate the future of employee healthcare benefits together.