Successfully selling employee benefits all comes down to understanding the unique wants and needs of your clients, and fulfilling those needs through strategic, customized benefits plans.

With drug costs on the rise, many employers are understandably looking for ways to offer benefits to their employees without jeopardizing their company’s finances. Understanding how to navigate those high drug costs and mitigate risk as much as possible is key to meeting those client needs and providing value added service as an employee benefits advisor.

It all begins with a client needs analysis.

Client Needs Analysis

How can you fulfill your clients’ needs if you don’t know what they are? Every successful client relationship depends upon your ability to converse with your client and understand what they’re hoping to achieve not only with their benefits plan, but with their business as a whole.

Knowing where your client is going helps you determine the best way to help them. All you have to do is ask!

Focus on asking your client future-based questions. After all, selling is ultimately engaging someone in a future-based result that’s good for them. Ask questions that give you a clear, concise, and specific view of your clients’ goals and ambitions. Are they looking to grow their business? Sell it? Merge? Enter new markets? Develop new products?

Whatever the answers may be, they will provide you with a clear road map of where they’re headed. Once you understand their desired trajectory, you can provide customized solutions to help them along that path.

Not only that, but reading between the lines, their answers will give you insights into their risk tolerance level. This is crucial when discussing high-cost drugs and the risks associated with them.

Drug Cost Management Protection

“Risk” means different things to different clients. Just as every client has their own definition of risk (and tolerance towards it), they also have their own preferred manner of handling those risks.

Some may gravitate toward implementing plan maximums, while others turn to managed formularies. You might consider maximum dispensing fees, per-prescription deductibles, or preferred pharmacy networks, for example.

It’s especially important for those smaller businesses to have risk mitigation strategies in place. If they’re unprepared and they encounter a large cost drug claim (or two, or three, or four), that could potentially have devastating financial repercussions on a smaller corporation.

A benefits plan is a promise that an employer makes to their employees. It’s your job as a benefits advisor to not only present solutions that enable your clients to make their desired promises, but also to ensure that their benefits plan is sustainable and able to continue into perpetuity (bonus tip: this is a great conversation to have when prospecting).

When it comes to mitigating the risks posed by high-cost specialty drug claims, you might want to have ClaimSecure’s Formulary Protect and Formulary Protect Plus plans on your radar.

Formulary Protect to Target High-Cost Drugs

ClaimSecure provides an innovative solution in the realm of high-cost specialty drug management.

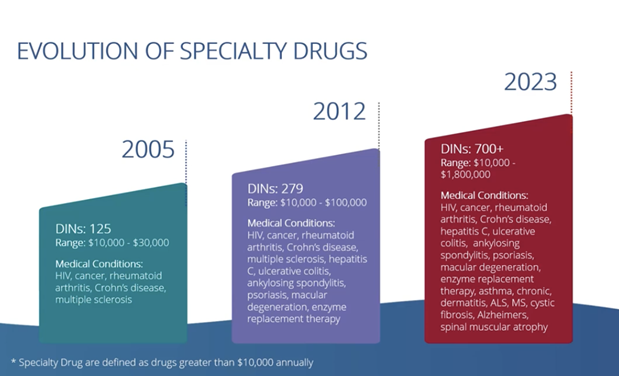

High-cost, specialty drugs are becoming more prevalent. There are increasingly more drugs on the market, available at higher costs, and used to treat a growing number of specific conditions.

However, traditional benefits plans are not equipped to handle these sorts of claims. With a generic drug cap, for instance, high-cost specialty drugs reach that cap extremely quickly. Once this happens, the employee is no longer able to receive even standard, run-of-the-mill prescriptions through their benefits plan.

Formulary Protect offers a more precise solution designed to address the problem of high-cost specialty drugs without incurring the collateral damage on those other drug claims. It indemnifies the employer’s benefits plan from paying for any drug that costs more than $10,000 annually, and it provides coverage navigation services to help the employee to find alternative funding for those high-cost drugs.

Coverage Navigation Services

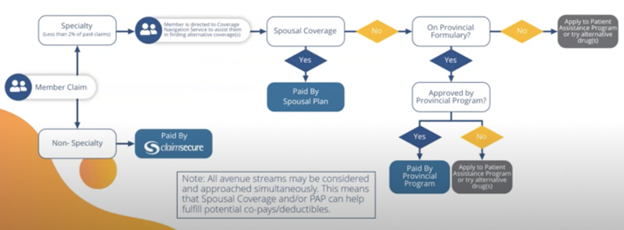

With Formulary Protect, employees with high-cost prescriptions are guided through the process of securing alternative funding. This funding is sourced in a variety of ways, pursuing several avenues of opportunity, and oftentimes producing a solution made up of multiple sources of alternative funding.

Coverage navigation services will pursue spousal plan coverage options and provincial drugs plans, as well as contacting pharmaceutical companies themselves to inquire about manufacturer patient assistance programs. They will assist employees with the application processes by aiding and submitting application forms, securing drug histories, and providing letters showing that the drugs are not covered on any corporate plan. Finally, they provide advocacy services to provincial administrators, case managers and specialist physicians, and pharmaceutical manufacturers to further ease the burden and help those employees to secure funding.

A Proven Track Record of Success

Formulary Protect has been in operation since 2016, and it has over 5,200 satisfied clients to date. It effectively removes all high-cost specialty drugs from the formulary coverage and aids employees in securing alternative funding for those drugs.

Not only does Formulary Protect prevent employers from incurring high cost, potentially financially devastating claims in the future, but it also decreases client costs through its ability to reduce risk and therefore reduce stop loss charges.

Provide Value Through Custom Plans and Regular Reporting

Asking those future-based questions gives you a road map to providing value for a client. Crafting custom plan solutions that meet their needs and mitigate risks according to their tolerance enables you to deliver that value and eliminate your competition. Regularly reporting results is how you maintain transparency, resulting in thin files and profitable long-term relationships.

When it comes to handling high-cost specialty drugs in particular, Formulary Protect is a very strong tool to have at your disposal. Ask the right questions and build that custom plan that provides value to your client and generates a mutually beneficial, successful relationship for years to come.

The Benefits Trust has been operating as a third-party administrator in the employee benefits space for just shy of 30 years, and we’re all about providing value to our clients and helping advisors to access the resources they need to do the same. For any information regarding navigating high-cost specialty drug claims, Formulary Protect, or employee benefits in general, please contact us at The Benefits Trust.