At The Benefits Trust, our primary aim is to help successful business owners build better benefits plans than they can find anywhere else. We do this by tailoring and customizing plans, as opposed to the traditional, one-size-fits-all solutions larger insurance carriers provide.

We recently partnered with a benefits advisor to help an Ontario business create a benefits package that allowed them more control over their benefits fees while also attracting high-calibre talent and ensuring their employees had a robust benefits package.

Facing the limitations of traditional benefits models, the business was looking for a more adaptable and transparent solution.

The Challenge

Originally engaged with a traditional fully insured benefits plan, the company found the initial low rates appealing. However, the subsequent significant rate increases at renewal, a common practice among traditional benefits providers, led to financial unpredictability and dissatisfaction.

The company sought a solution that would offer clearer insights into their benefits spending and grant them greater control over their plan, aiming to leverage their benefits package strategically for employee retention and recruitment without the constraints imposed by opaque and inflexible traditional plans.

The Solution

Recognizing the potential for self-insuring, the business’ benefits advisor reached out to us for our expertise and variety of plan options to support business owners. Working with the advisor, we reviewed the needs of the company and the goals they were looking to achieve, comparing their options with the renewal rate their current provider offered them.

Recognizing the potential for self-insuring, the business’ benefits advisor reached out to us for our expertise and variety of plan options to support business owners. Working with the advisor, we reviewed the needs of the company and the goals they were looking to achieve, comparing their options with the renewal rate their current provider offered them.

We analyzed their stressors when it came to their current plan and agreed with the advisor that an Administrative Services Only (ASO) plan would best suit their needs.

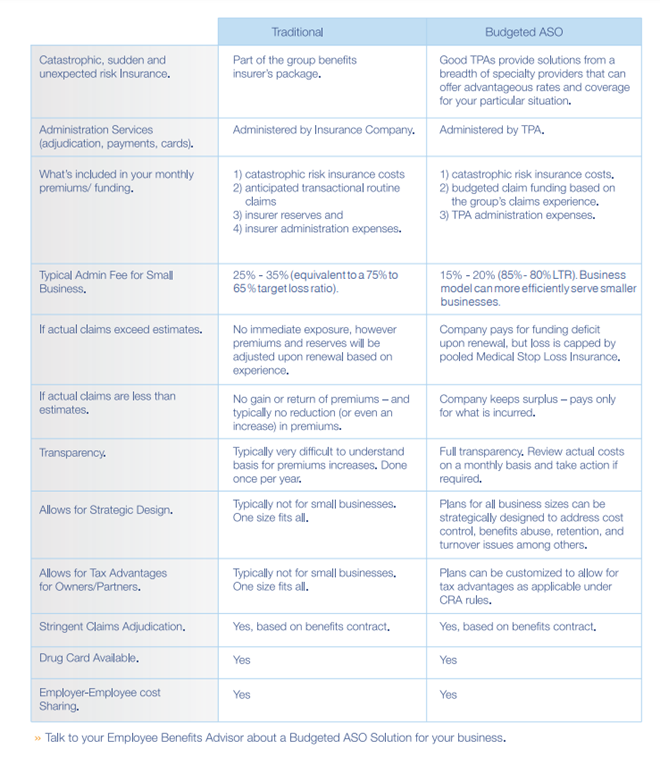

Explore the Differences Between Budgeted ASO vs Traditional Group Plans

The business was looking for an unlimited health and dental plan for the owners and needed the most efficient way to use those benefits without paying for everything out of pocket. An ASO plan acts similarly to an insured plan but allows for the transparency the business was looking for on a regular basis, with monthly financial reports to show them where their money is going.

The Benefits Trust played a crucial role in this transition, providing in-depth discussions on the advantages of ASO plans and engaging directly with the company’s stakeholders on calls to complement the advisor’s guidance.

Rather than behaving as a behind-the-scenes support, our team acted as partners with the advisor, becoming an instrumental part of demystifying the self-insured model for the company, showcasing the benefits of such a transition in terms of cost management, transparency, and plan customization. By the time discussions were over, it was a no-brainer, and the business had decided to transition to the ASO model.

The Results

This transition marked a pivotal change in the company’s benefits management strategy. The ASO model not only offered the anticipated transparency and control but also introduced an innovative approach to financial oversight through monthly financial reviews. These reviews became a cornerstone of the company’s benefits strategy, enabling the advisor to provide timely recommendations and adjustments as needed. This level of ongoing oversight allowed for dynamic management of the benefits plan, ensuring that the company could respond swiftly to changing needs and opportunities for optimization.

The advisor’s involvement and recommendations now allow the company a more strategic approach to budgeting for its benefits plan. Instead of annual reviews, which often lead to end-of-year budgeting surprises, the company can now make informed decisions throughout the year. This proactive financial management significantly eased the company’s ability to plan and allocate resources more efficiently, demonstrating the value of the advisor’s role in the successful transition to a self-insured model.

The Benefits Trust’s support in this process was integral, providing the necessary tools and guidance to empower the advisor, thereby ensuring a seamless and effective implementation that met the company’s needs for transparency, control, and strategic financial planning.

Conclusion

At The Benefits Trust, we help successful business owners provide superior benefits plans. We offer unique plan options that typical insurance carriers don’t provide and support advisors throughout the transition process, helping explain unique benefits strategies and support business owners as they navigate their benefits.

Are you looking to provide a plan that adds more value to your clients? Contact us today to get started!