Successfully selling employee benefits all comes down to knowing your client.

The building, trades, and construction industry in Ontario is an underserved market by insurance company solutions and it presents a great opportunity for benefits advisors to provide value for their clients and make a profit. There are 10,000 businesses within the industry in Ontario alone, and those businesses are expanding steadily as the need for housing in and around the Greater Toronto Area continues to grow.

Business decisions within the building, trades, and construction space are made slightly differently than your average business, and understanding and catering to those nuances will help you provide effective benefit plan solutions to your clients and find success as an advisor in the building industry.

Let’s take a look at how to sell employee benefits successfully and profitably within the building and construction industry in Ontario.

Perform a Client Needs Analysis

To best serve your client, you need to understand their needs. Ask questions to gain an understanding of where their company stands, where they’re headed in the future, and their general values and philosophies.

The best way to do this is to ask future-based questions. Asking future-based questions will yield future-based answers, which will essentially provide you with a road map of where your prospect is headed.

This road map will act as your guide as you set out to craft an effective, valuable custom benefits solution for that business owner.

Selling value is engaging someone in a future result that’s good for them. To do this well, you need to know their goals. Are they planning to sell their business, or grow? Maybe they’re merging with another company or taking on new markets, or perhaps the business owner plans to retire in the next year. This all influences how you approach the sale.

If you ask a building, trades, or construction company what gives them confidence as they look into the future, they very likely will respond by telling you that their reputation is what propels them to success.

In this industry a business’ future jobs are based on their past jobs, which means that maintaining a team of quality workers who can uphold that reputation is critical. Incentivizing employees with an enticing benefits package is an effective way you can help your clients keep that team, maintain that reputation, and ultimately help them reach their business goals.

What if they don’t engage with your questions? If they’re providing vague answers or not willing to engage with you at all, simply move on to the next prospect. This industry is bursting with opportunity, and there’s no reason to spend any time on a client or prospect who is difficult and unprofitable.

What Do They Want to Promise Their Employees?

A benefits plan is a promise between an employer and a group of employees.

Your role as a benefits advisor is to translate benefits jargon into language the client will understand. Framing benefits as a promise helps them view their benefits plan in a new light and realize that they’re free to promise what they please to their employees.

There are two main types of promises:

First, we have low frequency, high-cost promises. These happen rarely but when they do occur, the payout is significant. These promises require insurance and include things like group life, group AD&D, long term disability, critical illness, out of country travel insurance, and stop loss.

There are also high frequency, low-cost promises. These promises occur more regularly at a lower cost, and they require budgeting. This includes things like extended healthcare, prescription drugs, vision, dental, and health care spending accounts.

It’s up to the client to decide what they’d like to promise their employees. Framing it this way helps them understand the options they have available to them, and keeping in mind where the business is headed in the coming years, you as a benefits advisor can guide them to an ideal solution for their business.

Remember, you’re the expert! Lead the client down the path that you think makes the most sense for them and present them with that customized solution rather than a range of solutions.

The Builders Benefits Plan

At The Benefits Trust, we’ve created a benefits solution specifically catering the building, trades, and construction industry.

The Builders Benefits Plan makes it easy for advisors to discuss benefits solutions with prospects in the industry and finalize a decision quickly and profitably, with no guessing or games. The client has the ability to set their own budget and build a custom plan that works for their business and aligns with their specific goals.

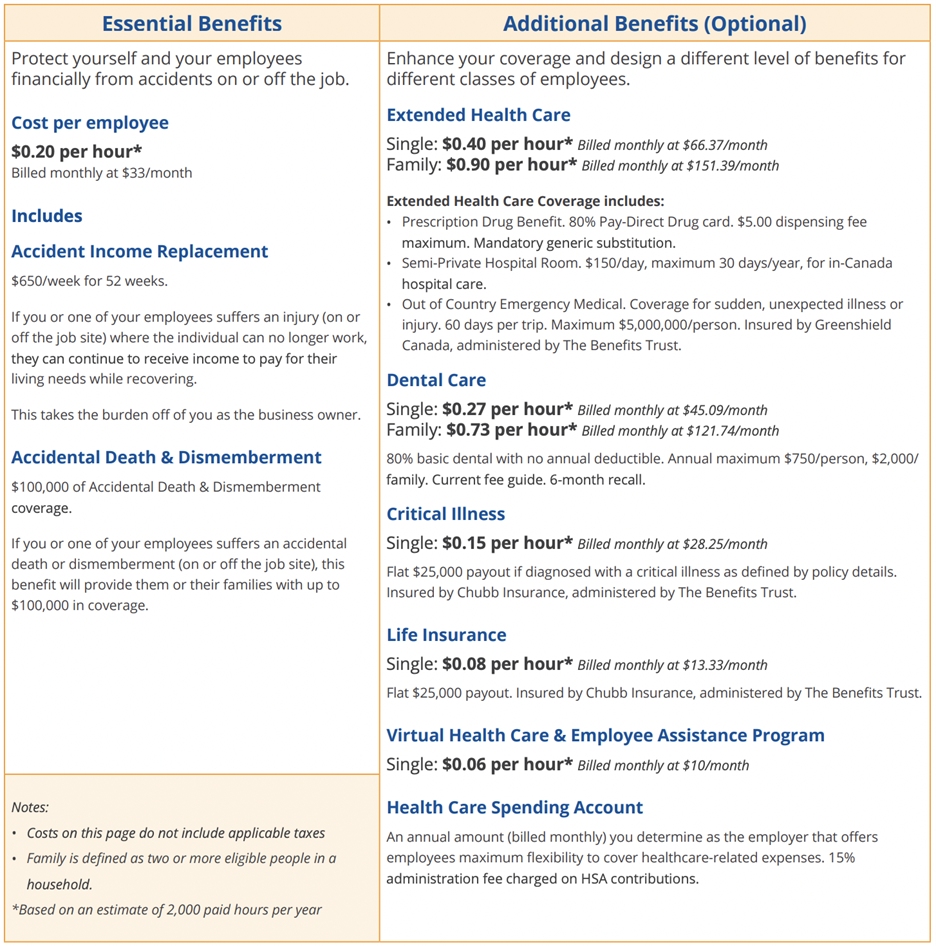

The only essential benefits incorporated in this plan are accident income replacement and AD&D coverage, both of which are pertinent to the industry since employees are particularly vulnerable to accidents and injury, both on and off the job site. The remainder of the plan is fully customizable based on the employer’s wants and needs.

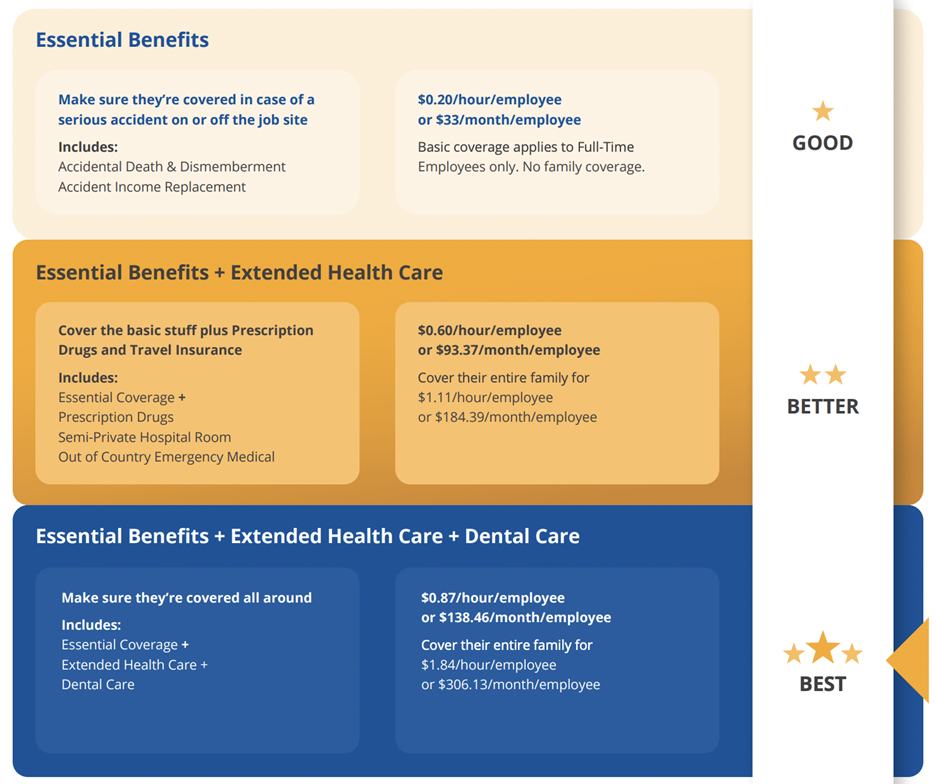

This sort of hybrid plan setup provides more satisfaction for employees and allows the employer to keep costs stable and predictable. Here are the top three most commonly used plan configurations:

What about costs? Businesses in this industry, more than any other, are acutely aware of their costs per hour. Knowing this, we’ve broken down the cost of the benefits plan on an hourly basis to help them quickly understand the financial impact it will have on their company and operations.

Benefits are a form of compensation, and presenting benefits by an hourly cost per employee enables business owners to incorporate those costs as part of their compensation and realize the promises that they’d like to make to their employees.

To help advisors and their clients explore different custom plans and understand the associated costs, we’ve developed an interactive Premium Calculation Worksheet. This can be utilized during sales meetings and sent to the prospects to provide an immediate and accurate estimate for their benefits plan.

Powered by The Benefits Trust, clients who use this plan will benefit from exceptional customer service and extremely quick claims processing. Clients can quickly submit claims through our app without any hassle or back-and-forth.

Taxation Considerations

All benefit plan costs are tax-deductible business expenses and framing it in this way can help prospects appreciate their plan from a new perspective.

This is why we strongly recommend 100% unlimited plans for business owners. When a business owner has a 100% unlimited plan, they entirely avoid paying for anything out-of-pocket and therefore all of their healthcare costs become tax deductible. The business owner ends up paying for all healthcare costs that they would have incurred regardless, but with a tax advantage – and every little bit adds up!

The exception scenario is when the business owner has a spouse with their own coverage, in which case a healthcare spending account could be the better option. It’s your job as a benefits advisor to inform them of the potential tax considerations and guide them to the most fitting custom solution for their needs.

Helping You Sell Profitably to Clients

The Benefits Trust has been providing third party administration services since 1994, and we’re here to help. If you’re in need of guidance or resources, or if you’re interested in The Builders Benefits Plan, please contact us today. We’re happy to answer any questions and do our best to help you sell profitably to clients in the building, trades, and construction industry!