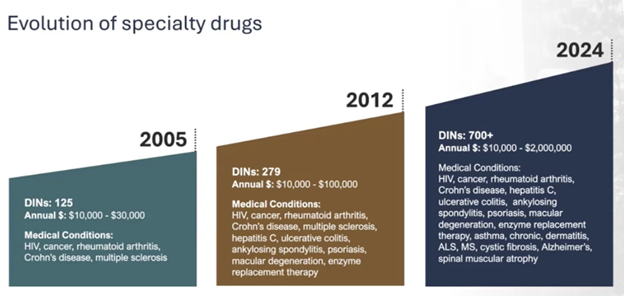

The specialty drugs market is changing, and managing the costs of high-expense drug claims has become a focal point for employers looking to preserve benefits and keep plans sustainable.

As a benefits advisor, this presents you with an excellent opportunity to provide clients and prospects with effective strategies that enable employers to protect against catastrophic drug claims while continuing to offer valuable coverage to their employees.

Why Effective Drug Management Matters

A benefits plan is simply a promise made by an employer to their employees. Business owners want to take care of their team members, but high-cost specialty drugs pose a great financial risk when not handled correctly.

Effective drug cost management ensures that employee benefits continue to support the team well into the future. Employers committed to this path are able to create a secure, predictable benefits landscape for employees, earning their trust and loyalty, without risking the financial stability of their business.

Historically, high-cost specialty drugs have posed a problem for employers. Either they include these drugs within their benefits plans and risk paying through the nose, or they exclude them from their coverage, leaving their affected employees out to dry.

Risk mitigation strategies act to please risk-averse employers, while also providing sustainable benefits to protect the health and financial well-being of employees.

In short, everyone wins!

Conduct a Client Needs Analysis

Before crafting a drug management strategy, it’s essential to understand where your client is heading. Conducting a client needs analysis helps tailor solutions that align with their long-term goals and risk tolerance.

It’s simple: ask your client future-based questions.

Their answers will provide a roadmap, helping you assess their risk tolerance temperature, among other things. Are they planning to grow, to merge, to enter new markets? Are they introducing new products or perhaps preparing for a sale?

Knowing their risk capacity enables you to design a plan that meets their unique needs, helping you to secure the trust and confidence that ensures a long-lasting relationship.

ClaimSecure Formulary Protect: A Targeted Solution for High-Cost Drug Management

Specialty drugs—defined as those costing over $10,000 annually—have expanded from rare, tertiary conditions to more common illnesses. For many organizations, these high-cost claims pose a significant financial risk, especially for small groups with limited resources.

That’s where Formulary Protect comes in.

ClaimSecure Formulary Protect offers an innovative solution to tackle these challenges head-on, enabling businesses to maintain sustainable, high-quality benefit plans without breaking the bank.

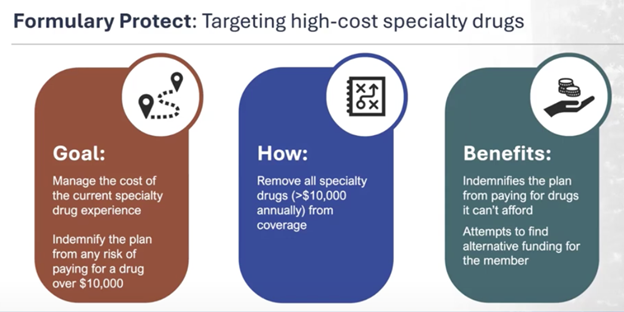

What is Formulary Protect?

Formulary Protect is a targeted, strategic approach to managing the costs of specialty drugs.

Unlike traditional cost-management solutions, Formulary Protect focuses on removing high-cost specialty drugs from coverage, thereby eliminating the plan’s exposure to catastrophic drug claims.

This solution is ideal for employers who want to ensure the longevity of their benefits program while maintaining essential support for employees’ health needs.

ClaimSecure’s Formulary Protect boasts an impressive 94% success rate in securing alternative funding for employees who need specialty drugs. This demonstrates the solution’s effectiveness in bridging the gap, ensuring employees receive necessary care without compromising the financial health of the employer’s benefit plan.

In some cases, Formulary Protect also assists in transitioning members to covered, lower-cost prescription alternatives, further reducing costs.

Key Objectives

Formulary Protect focuses on two primary objectives: cost management and risk management.

Cost Management

By excluding specialty drugs (those costing more than $10,000 annually) from the benefit plan, Formulary Protect significantly reduces the financial burden on the employer.

This approach realizes immediate cost savings, as the most expensive medications are no longer part of the plan’s claims.

ClaimSecure offers employees and employees third-party support to find alternative means of coverage for specialty drugs.

Risk Management

Formulary Protect is designed to mitigate future exposure to high-cost specialty drugs, effectively indemnifying the benefit plan against the risk of catastrophic claims. By removing specialty drugs from coverage, the plan avoids unpredictable and potentially unsustainable expenses, preserving the plan’s viability over the long term.

Together, these objectives allow employers to manage their current specialty drug expenses while securing their benefit plan against future high-cost claims.

How Formulary Protect Works

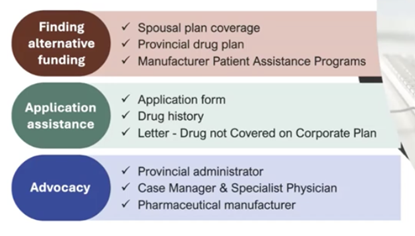

Under Formulary Protect, all specialty drugs exceeding $10,000 per year are removed from coverage. For employees needing these medications, the solution involves navigating alternative funding options, such as:

- Spousal plan coverage: If the employee’s spouse has a benefits plan that covers the medication.

- Provincial drug plans: Available in most provinces, with notable exclusions like Quebec.

- Manufacturer patient assistance programs: Many pharmaceutical companies offer financial support for patients who cannot afford their medications.

Coverage Navigation Services are in place to guide employees through accessing these alternative funding resources. These services provide essential support for employees, helping them secure coverage for high-cost medications without impacting the benefit plan.

The support includes:

- Application Assistance: Help with completing applications, compiling required drug history, and preparing necessary documentation, such as letters confirming the drug’s exclusion from the corporate plan.

- Advocacy and Support: Formulary Protect connects employees with provincial administrators, case managers, and pharmaceutical companies, ensuring they receive the necessary aid and guidance to access funding.

Securing alternative funding can be a stressful and complicated process, and this navigation service seeks to simplify the experience and ensure that employees are supported. This support goes beyond coverage—it empowers employees to access necessary medications even when they aren’t included in their benefit plan.

Formulary Protect as a Prospecting Tool

For advisors, ClaimSecure Formulary Protect is a valuable asset for both prospecting and client retention. It provides a proactive solution to the escalating costs of specialty drugs, a topic which concerns many business owners, but which is often overlooked by advisors in the prospecting process.

By introducing Formulary Protect, you position yourself as a trusted partner who understands the importance of balancing employee coverage with financial sustainability—an approach clients truly value.

Remember, a benefits plan is simply a promise. Formulary Protect can help your clients make a promise that supports their employees without jeopardizing their finances.

The Benefits Trust has successfully administered third-party benefits for over 30 years, and we’re here to help you to navigate the evolving world of high-cost specialty drugs. From prospecting resources to Formulary Protect client presentation support, The Benefits Trust is here to help. Contact us today!