Canadian health benefit plans can do a lot more to keep up with employees’ changing needs and expectations, revealed this year’s Sanofi Canada Healthcare Survey.

Canadian health benefit plans can do a lot more to keep up with employees’ changing needs and expectations, revealed this year’s Sanofi Canada Healthcare Survey.

The annual survey asks 1,500 primary holders of group health benefits plans across the country to rate workplace supports for healthcare management. This year’s results revealed employee expectations are changing – and benefits plans are not keeping up. Employees want more flexible, personalized, and integrated benefits, which are often not offered in traditional benefits plans.

At The Benefits Trust, we have been advocating for customized benefits plans for a long time. We believe they should be tailored to support your business goals and to meet the diverse needs of your employees.

Read the full 2016 Sanofi Healthcare Survey.

It’s Time to Integrate Benefits and Wellness

“Health benefits must change if they are to survive – and fulfill their potential as agents for productivity in the workplace,” concludes the Sanofi Canada Healthcare Survey advisory board.

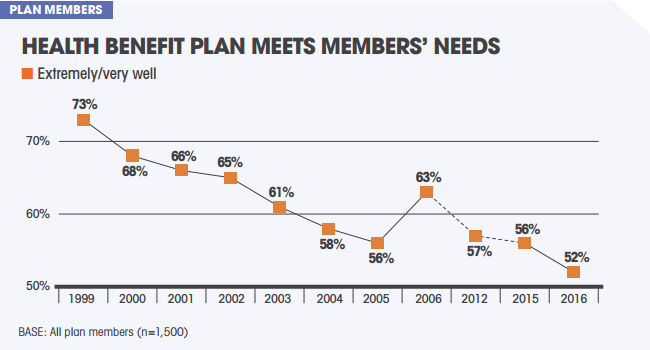

Plan members rated health benefits plans at an all-time low for meeting needs, likely because plan designs haven’t changed or kept pace with plan members’ expectations.

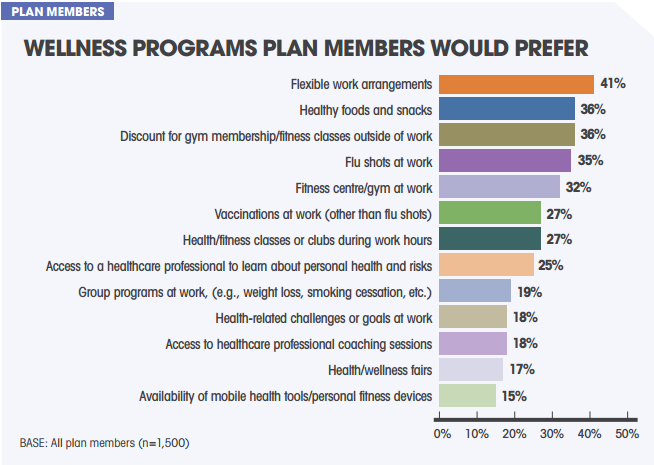

Employers interested in reversing this trend need to start focusing on integrating benefits and wellness programs into a health management plan. Plan members with access to wellness programs are much more likely to agree that their health benefits plans meet their needs.

We’ve seen great success since introducing our innovative health and wellness benefit, Health Connected. This helps employees take a more proactive stance to understanding and managing their health over time, which makes them more productive, engaged, and less absent employees.

Healthcare Spending Accounts Offer Employees Personalized and Flexible Benefits

Employees rated healthcare spending accounts (HSA or HCSA) as low in importance, but this could be due to lack of understanding or awareness.

“Generally, people don’t fully understand health spending accounts. When you consider that employees value their prescription and dental plans the most, they should value HSAs as much since they can be used for those expenses,” said Art Babcock, a member of the Sanofi Canada Health Survey Advisory Board.

Healthcare spending accounts also offer benefits that might not meet the traditional definition of ‘medically necessary’, such as massage therapy. Employees can choose which services they want to spend their HSA on, giving them flexibility in their coverage.

The Advisory Board recommended a reboot of health spending accounts, envisioning a “defined, contribution, super health spending account” that would process all claims for drug, dental services, vision care, plus eligible paramedical services. It would also offer a wellness account for taxable items such as personal trainers, nutritionists, and financial advisors.

While we await the invention of this hybrid super account, you can still set up separate HSA and wellness accounts today.

Want to learn more? Watch our video: What Is a Healthcare Spending Account?

We’re big proponents of healthcare spending accounts because when compared to a conventional benefits plan, HCSAs offer greater cost control, increased flexibility for both employers and employees, and increased employee choice.

Contact us today to discuss how we can build a custom benefits plan that suits your organization’s specific needs – we can help you build a better benefits plan than you can get anywhere else.

Check out our FREE eBook for a comprehensive look at HSAs: “The Smart Business Owner’s Guide to Healthcare Spending Accounts.”

More from The Benefits Trust: You may also like:

- How Do You Transition from a Conventional Benefits Plan to a Healthcare Spending Account?

- Are All Your Eggs in One Basket with Your Benefits Plan? Add Stability and Flexibility with a Full Service Third Party Administrator

- Introducing “Health Connected” – A New Wellness Benefit from The Benefits Trust!